Short term capital gains calculator

You need to feed your property sale purchase date along with values. A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price.

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Selling a capital asset after owning it for less than a year results in a short-term capital gain which is taxed as ordinary income.

. These gains are bifurcated into two types long-term capital gain and short-term capital gain on Mutual Funds. Thanks for writing to us. In a hot stock market the difference can be significant to your after-tax profits.

The big difference between long-term and short-term capital gains is how theyre taxed. Short term capital gain as under Section 111A. Additionally you can only deduct up to 3000 of net long-term capital losses in a given tax year.

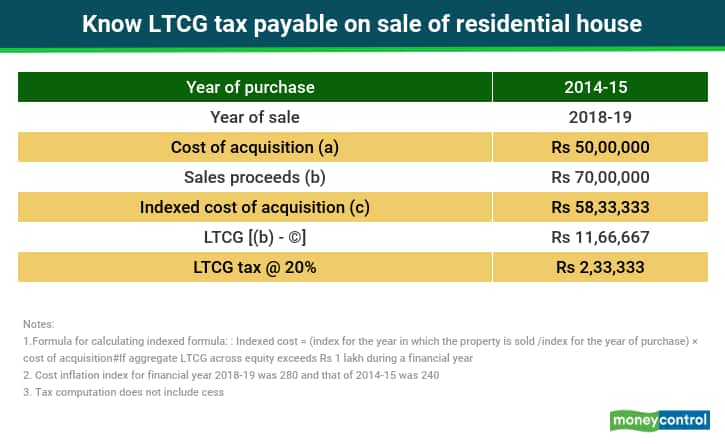

Short-term capital gains are treated as income and are taxed at your marginal. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status. September 14 2022 We have compiled an Excel based Capital gains calculator for Property based on new 2001 series CII Cost Inflation Index.

Short term capital gains arising out of sale of bonds government securities and debentures. If you have 5000 of a short-term loss and a 1000 short-term gain the short-term loss of 5000 can be deducted against the net long-term gain if you have one. The tax rates for short-term capital gains are the same as those of your income tax slabs.

Short-term capital assets are taxed at your ordinary income tax rate up to 37 for 2022. Any excess net long-term capital losses can be carried forward until there is sufficient capital gain income or the 3000 net long-term capital loss. Long-term capital gains result from selling capital assets.

Further you can also file TDS returns generate Form-16 use our Tax Calculator software claim. Short term capital gains arising out of sale of immovable property silver goldetc. There is option to include cost of repairsimprovement that you might.

As a result they might put you in a different tax bracket compared to short-term capital gains. For example short-term capital losses are only deductible against short-term capital gains. Thats because long-term capital gains tax rates at 0 15 or 20 are generally more favorable than short-term rates which follow ordinary tax brackets.

For instance the capital gains you earn from equity funds for a holding period up to one year are called short-term capital gains or STCG. Types of capital gains and Mutual Funds. Short-term capital gains are gains you make from selling assets that you hold for one year or less.

Typically the short term capital loss carryover would be used to offset the short term capital losses and the long term capital loss carryover would be used to offset the long term capital losses in a current year. Capital gains taxes are also. All property transactions attract short term capital gains tax provided property transfer happens within 3 years of ownership.

The calculator on this page is designed to help you estimate your projected long-term capital gains tax obligation based on the income made from your assets as well as the nuances of your financial circumstances. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. Theyre taxed like regular income.

Your gains are simply added to your gross income and taxed according to your federal tax rate. It represents the length of time for which an entity owned a particular fund. Short-term capital gains are taxed like other ordinary income such as wages from a job.

Long-term capital gains are taxed at a lower rate than short-term gains. It calculates both Long Term and Short Term capital gains and associated taxes. Noting the key difference between long short term capital gains.

Capital Gains Tax. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Long-term capital gains are when you hold an investment for more than a year after purchased.

Any short-term gains you realize are included with your other sources of income for the year for tax purposes. The Difference Between Long-Term and Short-Term Capital Gains. The short term capital loss carryover from 2020 can be used to offset the long term capital gain in 2021.

However long-term capital gains are taxed at 20. Check out these links for more. A good capital gains calculator like ours takes both federal and state taxation into account.

For short-term capital gains youd be at 24. Get 247 customer support help when you place a homework help service order with us. Calculated by adding capital gains to income.

You can claim exemptions under Section 54 of the Income Tax Act. Know about Computation Tax Rate Capital Assets. Noting the key difference between long short term capital gains.

Short Term Capital Gain on Property. It is calculated on the capital gains. Capital Gains Taxes on Property.

How To Save On Capital Gains Taxes When Selling Property and All About Capital. Gains from equity shares listed on a recognised stock exchange having a holding period of less than 12 months are considered as short term capital gains. Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too.

Section 111A is applicable in the case of STCG on the purchase or sale of-Equity shares or equity-oriented mutual fund units. Capital gains tax is the tax paid on profits you make from selling an investment for more than it was purchased for. For example if you earn 100000 a year youre in the 15 tax bracket.

Long-term capital gains are taxed at 0 15 and 20 depending on your taxable income. So if you have 20000 in short-term gains and earn 100000 in salary from your day job the IRS considers your total taxable income to be 120000. The classification of gains originates from the holding period of the sold security.

But if a net capital loss of the year is more prominent you can actually deduct up to 3000 of the loss against other forms of income like salary. Use our capital gains calculator to determine how much tax you might pay on sold assets. You have either short-term or long-term capital gains depending on the holding period of your investment.

Weve got all the 2021 and 2022 capital gains tax rates in one. A rate of 20 is levied on deft-oriented funds and real estate assets after indexation. Total income is taxed as per an individuals tax slab.

This Page is BLOCKED as it is using Iframes. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset. Short-term capital gains are when you buy an investment and sell it in a year or less.

Short Term Vs Long Term Capital Gains White Coat Investor

How To Calculate Capital Gains On Sale Of Gifted Property Examples

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gain Formula Calculator Examples With Excel Template

The Long And Short Of Capitals Gains Tax

Here S How Much You Can Make And Still Pay 0 In Capital Gains Taxes

Capital Gains Tax What Is It When Do You Pay It

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

The Tax Impact Of The Long Term Capital Gains Bump Zone

Capital Gains Meaning Types Taxation Calculation Exemptions

Short Term Vs Long Term Capital Gains White Coat Investor

How To Calculate Long Term Capital Gains Tax Capitalmind Better Investing

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

How To Calculate Capital Gains On Sale Of Gifted Property Examples

Short Term Vs Long Term Capital Gains White Coat Investor

Tax Calculator Estimate Your Income Tax For 2022 Free

Capital Gain Formula Calculator Examples With Excel Template